The Central Bank of Nigeria Dilemma — Recession vs Inflation By phoenix agenda

That Nigeria is in a recession is no longer news, perhaps the only mystery is the degree to which the economy shrunk in second quarter (Q2) 2016 as we await the Nigerian Bureau of Statistics (NBS) confirmation. How Nigeria fell into a recession has been discussed in a previous article, see here. Naturally the focus is now on what needs to be done to reverse the situation and get the economy back into growth mode. In this regard a lot of focus and expectation is being placed on the Federal Government (FGN, and quite rightly), such that it seems the Central Bank of Nigeria (CBN) is being given a free pass.

This is a strange situation as as in my view combating a recession requires a combination of appropriate and effective fiscal and monetary policies. It is therefore pertinent to explore the CBN position; what it is doing/has done, what it can do and what it should do.

The CBN Response

After the NBS released its first quarter (Q1) 2016 GDP report which showed the economy had contracted by 0.36%, CBN’s first response was to address the issues surrounding the Naira. This had become more pertinent once the FGN had in May 2016 announced a new petrol pricing model based primarily on an exchange rate much closer to the parallel market rate than the CBN official rate.

In June 2016 CBN floated the Naira as a measure to address foreign exchange (FX) availability issues once and for all (policy has met with mixed success as political pressure continues to limit flexibility). In July 2016 the CBN had its first Monetary policy Committee (MPC) meeting post the NBS Q1 2016 GDP report and the new Naira floating regime. The CBN therefore had the first opportunity to make a formal response to the spectre of recession that loomed large on the horizon.

The MPC rightly surmised that it had two conflicting policy issues to address and would have to pick one to possible detriment of the other i.e. growth or inflation. After its deliberation the MPC chose to address inflation by raising the Monetary Policy Rate (MPR) by 200 basis points to a record 14%. In doing this, the MPC made the following statement:

“The MPC, recognizing that the Bank lacked the instruments required to directly jumpstart growth, and being mindful not to calibrate its instruments in such a manner as to undermine its primary mandate and financial system stability, in assessment of the relevant issues, was of the view that the balance of risks remains tilted against price stability. Consequently, five (5) members voted to raise the Monetary Policy Rate while three (3) voted to hold.”

The outcome of the MPC meeting in July 2016 was not entirely a surprise (quantum of the rate hike was unexpected though). The CBN is rather fastidious about its price stability mandate (it sets itself an upper limit of 9% for inflation and with June 2016 inflation at 16.5% must have gone into a panic), as well as its focus on managing a stable FX rate for the Naira. By raising rates the CBN hoped to curb inflation while simultaneously attracting FX flows from foreign investors who would see the combination of a floating Naira and high yields on fixed income instruments as positive. The question is: was the MPC right to choose inflation and fx availability over growth?

Can Central Banks combat recession?

To combat recession, growth needs to be stimulated. Essentially this requires increased economic activity across all sectors and typically the government has a big role to play by taking an expansionist stance and spending heavily on infrastructure and areas that create jobs and aid investment and consumption. Government can also cut taxes, grant waivers and use other fiscal levers to get private consumption and investment up to stimulate the economy. However, the government cannot do this in isolation as fiscal policies alone will not do the trick. The MPC acknowledged this as part of its communiqué when it said:

“The MPC recognized the weak macroeconomic environment, as reflected particularly in increasing inflationary pressure and contraction in real output growth. In view of this,the MPC underscored the imperative of coordinated action, anchored by fiscal policy, to initiate recovery at the earliest time. Members called on the Federal Government to fast-track the implementation of the 2016 budget in order to stimulate economic activity to bridge the output gap and create employment.”

The FGN stated an intention to begin implementation of the budget as soon as it was passed in May 2016 with the Finance Minister indicating that a N350Billion stimulus package was ready to be disbursed. In an appearance before the Senate in July 2016, the Minister for Budget and Planning Senator Udo Udoma announced that the sum of N235Billion had already been released for capital projects so far. Essentially the FG is already doing its part, albeit not at the pace it needed to get to given the delay in passing of the budget and the revenue generation challenges. Over to the CBN for complementary monetary policies in support of the FGN action.

In reviewing what a Central Bank can do to combat recession, the Bank of England’s (BOE) recent response to the result of the June 2016 EU stay or leave referendum offers a view. The BOE cut the policy rate to 0.25% (half of previous rate) and plans to implement a GBP60Billion asset purchase program, extending its existing Quantitative Easing (QE) program to GBP435Billion. Governor Mark Carney announced this as a measure to forestall possible recession as a result of the Brexit vote. The BOE’s action mirrors similar programs implemented by the Federal Reserve Bank (FRB) in the wake of the Global Financial Crisis in 2008/2009 as well as the European Central Bank (ECB) and the Bank of Japan (BOJ).

In the last decade Central Banks have more than ever before shown a willingness to take on the fight against recession as their primary mandate and in most cases have been successful. We have seen Forward Guidance become a key tool in the hands of central banks with the FRB and BOE using it to great effect. The FRB in particular anchored a decision to raise rates based on unemployment falling below a certain benchmark, showing that the focus was on growth in coming out of the great recession. Today unemployment in the US has gone from a high of 9.8% in January 2010 to 4.9% in June 2016, the economy is prospering and it is largely due to the actions of the FRB.

Given the actions by other central banks as shown above the MPC’s choice of inflation over growth is therefore a strange one. It is particularly so because the MPC acknowledges that the recent hike in inflation is due to structural issues and it is a cost push inflationary trend (due to fall in value of Naira and petrol price hike), which would most likely not respond to monetary policy action. It almost seems as though the MPC decided to protect itself from a possible backlash by holding on to their price stability mandate at the risk of the entire economy. While rising inflation is a cause for concern, a recession portends grave danger for a country of 180 million people with a reported 70% already below the poverty line.

Nigeria simply cannot afford to have a CBN that is thinking of anything other than stopping this recession dead in its tracks.

A recalibration is needed

The MPC’s position that it lacks the instruments to directly jumpstart growth is quite worrisome. More than the FG whose spending is between 5–6% of GDP (not significant enough to cause a shift) and relies more on fiscal policy measures to steer the economy, the CBN has a wider influence as it controls the banking industry and can use monetary policy to improve liquidity and steer it in the direction that will yield growth. A case in point is the Banking Consolidation exercise of 2005 implemented by the Professor Charles Soludo led CBN, which not only changed the landscape of Banking but made the financial sector an engine for growth.

In this vein, the CBN should therefore take the lead in the quest for recovery. It should retrace its steps and come up with a well considered strategy to drive the country back on its path to growth. A number of actions are recommended below:

Think long term rather than short term. The rate hike was a short term measure not only to arrest inflation (which is not likely to happen) but more importantly to attract foreign portfolio flows (FPI) to deepen the FX market. While this is good, there are other more effective ways to address the FX availability issue which the CBN seems fixated with. For now growth is the key issue and it is more effective to address the structural issues in the economy to stimulate growth. This should then attract foreign direct investment (FDI), which offers more stability and longer term participation in the Nigerian economy. CBN needs to think long, not short…..Nigeria can survive the FX shortage for a while longer to get it right.

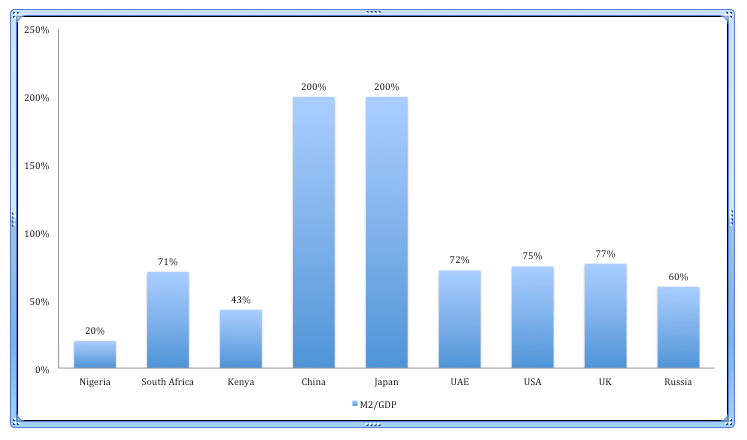

Improve liquidity. The Nigerian economy is liquidity starved! CBN’s adoption of inflation as its most important measure has seen it favour tightening rather than flexibility in managing liquidity. This can be seen when one looks at Broad Money (M2) to GDP statistics for Nigeria and a number of countries as follows:

As seen above Nigeria is way behind other countries and it is perhaps a function of the CBN not recalibrating liquidity after the GDP rebasing exercise. Simply moving M2 to 30% by creating new money and implementing QE will inject about N10Trillion into the economy. If that is channeled toward infrastructure projects such as power and transportation the economy will surely be on its way to growth sooner rather than later with minimal inflationary fallout.

Reduce the MPR by 400 basis points and ensure this is passed on by banks to their customers. 10% MPR retaining the current -500/+200 corridor should see a loosening of the credit space and encourage investment and consumption. This coupled with additional liquidity from CBN’s proposed QE program will help to support SMEs who are at this moment struggling with high operating costs (due to poor power supply and inadequate transportation) as well as high credit costs. This should also help to reduce borrowing cost for the FGN and help bring recurrent spending down to more manageable levels. In addition, CBN should set aside N3–5Trillion for really low cost lending that should get to end user at no more than 5% for Agriculture, Manufacturing and Housing (Mortgages).

Set limit for government lending at 10% of total loan book for commercial banks to push lending toward private sector. Government borrowing has in the past crowded out private sector as banks preferred to take on “safer” government risk. CBN should step in to reverse this and push out credit across different sectors. Banks should be encouraged to take on informed and considered risks to enable entrepreneurs get the economy going. With the Treasury Single Account now in play it should be easier to have banks move their focus from public sector to private sector now that they no longer have public funds to play with.

Further liberalization of the FX market and remove the ban from the FX window for the 41 items.Two key sectors of the economy are Trade and Services and they are both dependent on FX availability. CBN statistical database shows that there continues to be significant FX inflows into the country through autonomous sources but outflows continue to be sourced primarily from the CBN supply. The CBN must work to ensure there is only one FX market by removing all restrictions and allowing everyone access to FX at whatever price is determined by the market. It should make it impossible for people to hold FX balances in Nigeria or use FX as an investment vehicle in local accounts. The Naira is the legal tender here and should be the sole means of exchange or investment within Nigeria. All FX in Nigeria should be available for trade in the FX market and CBN needs to be firm in making this happen and taking away the opportunity that some have to put pressure on the Naira.

A call to action

The CBN has a massive role to play in getting Nigeria on the road to recovery, I daresay it has an even bigger role than the FGN. The outcome of the recent MPC meeting did not show a CBN that appreciates and accepts this role. This is especially more worrisome in the face of an inexperienced FGN short of capability in economic management. The CBN must undo its recent rate hike and then take control of driving the economy forward.

Nigeria’s economy has grown significantly in spite of the FGN and not because of it. This is seen by the fact that oil which is the mainstay of government income, made up less than 20% of GDP at its peak in 2013. The Nigerian economy is driven by private enterprise, with a significant portion of that being SMEs and the informal economy. With its monetary policy levers and banking sector oversight, the CBN is best placed to drive the economy back into growth, this time in an effective and sustainable manner.

The clock is ticking.

Comments

Post a Comment