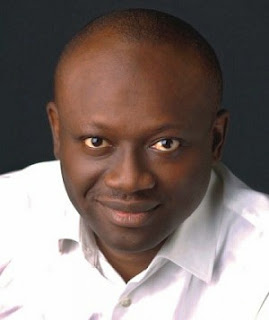

Whose interest is it anyway? by Simon Kolawole

Baffling. That’s the word. When Mrs Kemi Adeosun, the minister of finance, publicly canvassed that the Central Bank of Nigeria (CBN) should lower interest rate, I was baffled. Although the CBN is theoretically independent of the executive arm of government, we are in such a delicate situation that you do not want managers of the economy to say things that could paint the picture that they are not on the same page. I was wondering: if the monetary policy committee (MPC) eventually decided not to lower the rate, what point would Adeosun have made? That she wanted a lower rate but the bad guys in MPC refused to co-operate with her?

For clarity, I’m not saying the minister does not have a point. The government wants to borrow to embark on projects. If the government executes big projects, there will be more money in the economy, meaning consumption will be stimulated, meaning manufacturers can produce more, meaning more jobs can be created, meaning we could take a step out of the recession. As Adeosun put it, “My position has been: this government is spending its way out of trouble, and that spending, much of it, is being borrowed. So if you increase the interest rate, you increase our cost of debt service… when you are in a recession, you cut interest rate to stimulate activity.”

Perfect. Except that pharmacologists are obliged to list the side effects of a drug, and doctors will see if these side effects are manageable. The common paracetamol you use for headache can damage your liver if care is not taken. There is something called chemically induced hepatitis. Google it. You are treating high blood pressure with drugs that can cause kidney failure. Your economy is afflicted by what economists call “stagflation” — which a villager like me will define as a cocktail of unrelenting high inflation, high unemployment and sluggish demand. If your super solution is lowering interest rate to encourage borrowing, you may also be asking for kidney failure.

As it turned out, the MPC decided to — how else can I put it — do nothing. They retained the monetary policy rate (MPR) — the rate at which banks borrow from the CBN before lending to one another and, if they are happy, customers — at 14%. The MPC also retained the cash reserve requirement (CRR) — a fraction of the total customer deposits that banks must keep with CBN — at 22.5%. We are already dealing with inflation at 17.6%, caused mainly by forex-induced rise in prices of fuel and food. Lower the interest rate, flood the economy with cash and your inflation headache doubles. Paracetamol overdose can kill. We must weigh the trade-offs.

So what is the solution? You are asking the wrong person. People are paid handsomely to think for the government. All of them need to lock themselves up in a room and put on their thinking caps. But before they lock the door, I have some questions and observations to whisper to them. We want the manufacturers to restart their plants, isn’t it? We want Nigerians to be able to buy goods, right? We want an inflow of foreign investment — whether portfolio or direct, not so? We want to substitute imports in order to grow the naira, correct? We want millions of unemployed youth to find jobs, sure? All said and done, we want to “reflate” the economy.

Then I know what is NOT the solution. One, lowering interest rate, as logical as it sounds, may not produce the desired result. Indeed, it was not only Adeosun that wanted it lowered. Frank Udemba, president of the Manufacturers Association of Nigeria (MAN), also called on the CBN to cut rates to drive growth. “It is what we have been agitating for since and if the interest rate is brought down, it will be the best decision in the current economic dispensation,” he said. In the ideal world, Mr. Udemba, in the ideal world. The assumption is that the banks will in turn lend cheaper to industry. But that would only be in the Nigeria of our dreams. I will explain shortly.

Two, reducing the CRR may not work. Last year, President Muhammadu Buhari instructed that all public sector funds should be swept to the treasury single account (TSA). In one fell swoop, trillions of naira flew out of the banks’ vaults and landed at the CBN. The central bank governor, Mr. Godwin Emefiele, while addressing the media after the MPC meeting in September 2015, said CRR had been reduced from 30.5% to 25% to allow the banks to have more cash to compensate for the TSA slaughter. That alone ploughed back over N1 trillion into the banks. Emefiele said it would allow the banks to lend to industry and agriculture to stimulate economic growth. In his dreams.

What happened next? Ask the banks. How many manufacturers benefitted? How much credit went to agriculture? It would be interesting if every bank can publish the loans they’ve given out in the last one year and list them sector by sector, showing us the percentages, indicating “before” and “after”. And for those lucky chaps in industry and agriculture who were able to get loans, at what rates? The notion that giving banks favourable conditions will make them pass the benefits to the critical sectors is overhyped. Nigerian bankers are not exactly excited by all this talk about economic growth when they are getting high on FX simply by charging customers parallel market rate.

Why can’t the CBN just bring out koboko and whip all these banks into line? As much as the CBN tries to incentivise the banking sector to lend to the real sector and help our economy grow, we are not running a command-and-control system. The CBN cannot force banks to lend to the preferred sectors. Banks have a way of enjoying concessions and incentives and passing little or nothing to customers. They will tell you it is about risks, that they are not Father Christmas. Even sanctioning them can be suicidal. The CBN had to quickly beat a retreat recently when its action against banks for flouting the TSA directive almost drowned the markets.

We are what we are as Nigerians. If we lower the interest rate today, it is highly likely that the bankers (and even manufacturers?) will capitalise on the cheaper funds to continue the speculative attacks on the FX markets. You know how it works. Get billions of naira out of the system, buy forex, keep it, drive up the exchange rate and then sell. Profiteer on FX and return the naira to the bank. A lot of this has been happening. Certainly, the bubble in the stock market in the late 2000s followed the same pattern of financial buccaneering — until it collapsed on everybody’s head. Pray, who really has the interest of the Nigerian economy at heart? It’s always about the belly.

Before the managers of the economy lock the room, let me contribute my unsolicited input to their agenda. One, they should stop antagonising each other through the media. It helps nobody. Two, we need a handshake between monetary and fiscal policies. Many experts have consistently said that looking up to the CBN to get us out of this crisis with interest rates is like asking a doctor to prescribe cough syrup for tuberculosis. It may suppress the cough but it won’t kill the bacteria. Three, we need forex inflow badly. We must find ways of bringing in foreign investors. These capitalists used to love Nigeria because of the high rate of return. What went wrong?

Finally, as I canvassed recently, we need stimulus. Government must implement the 2016 budget. The CBN has a way of providing the money without worsening inflation. States and councils must pay salaries so that purchasing power can be improved, for demand and supply to give each other a bear hug. We need a creative, comprehensive road map out of this crisis with deliverables clearly mapped out, complete with timelines and milestones. The bankers and their banks must also discipline their greed. All hands must be on deck. We need to put the interest of Nigeria above anything else in these troubled times. My two cents.

AND FOUR OTHER THINGS…

ZAMFARA KILLINGS

May I once again draw the attention of the federal government to the unending killings in Zamfara state? When Boko Haram started, we thought it was a Maiduguri problem. We now know better. Or do we? In one attack by these Zamfara bandits last year, 48 persons were mowed down in Kizara. The gunmen moved from house to house killing and raping. With the killings still on, where on earth is Governor AbdulAziz Yari Abubakar (who likes to be called “Dr”)? Have you seen him lately? He is of average height, chocolate-complexioned, has a Fulani facial mark and speaks Hausa, Fulfude and English. If found, please drag him by his babariga to the nearest police station. Irresponsible.

SEMINAR SICKNESS

Nigeria is open for business again. By that, I mean we have, again, started organising seminars and conferences in foreign countries to say we are open for business. In New York, US, on Thursday, the Corporate Council on Africa, in conjunction with the Nigerian Investment Promotion Commission (NIPC), played host to Nigerian ministers who went to “educate” the world on investment opportunities, the ease of doing business in Nigeria and the roadmaps to address the current economic crisis. I hope the investors were instructed to bring their torchlight to Murtala Muhammed Aiport? Did we also tell them two officials will check their passports on arrival? Bienvenue.

SANUSI’S FRANKNESS

My respect for the emir of Kano, Alhaji Muhammadu Sanusi II, has increased with his consistency in speaking truth to power. When, as CBN governor, he indicted the NNPC of not remitting $20 billion to federation account, he was accused mostly by southerners of fighting a Muslim, Fulani and northern war against President Goodluck Jonathan, a Christian and southern minority. However, he has not stopped criticising President Muhammadu Buhari’s economic policies. Buhari, the last time I checked, is a Muslim, Fulani and northerner like him. I know this is a big disappointment to those who love to see Nigeria only from the blind prism of ethnicity, region and religion. Pity.

MERCI BEAUCOUP!

I want to express my gratitude to everyone who sent condolence messages and prayed for me over the death of my grandmother, Mrs Deborah Oludoyi, whom we buried on September 17. I was really overwhelmed with your kind words following the publication of my tribute to her last week. Many of my friends and well wishers were unhappy with me for not informing them I lost my grandmother — and for not inviting them to “come and eat”. I had a readymade excuse: in line with federal government guidelines on how to survive the recession, we had calculated every grain of rice, every morsel of pounded yam and every piece of meat! Lol.

Comments

Post a Comment