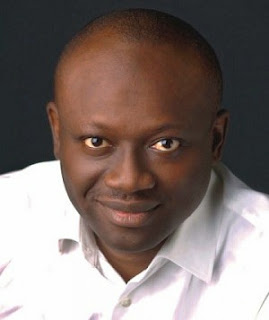

Rhapsody of subsidies and realities By Simon Kolawole

God forgive me. When Yemen’s Houthi rebels hit two key oil installations in Saudi Arabia a couple of weeks ago, I was not sad. I read somewhere that oil could hit $100 as a result and the little rascal in me smiled. I was thinking of the extra revenue for Nigeria, the impact on our forex reserve position, the lifeline for the naira and the infrastructure President Muhammadu Buhari could build with the extra income. I may not be able to vouch for Buhari’s ability to speak ex tempore in a panel discussion or give a Martin Luther Kingish speech, but I can say that if he has access to good money — as others had when oil was $100 — Nigeria will become a huge construction site.

My enthusiasm slowed down almost immediately. If oil price hits $100, the landing cost of petroleum products will also go up — since we rely on fuel importation. With the pump price for petrol fixed at N145 come rain or shine, it means the subsidy bill will also go up. Currently, petrol comes in at N194 — that is a subsidy of N49 per litre. There is also a forex subsidy because fuel importers get a concessionary rate of N305/$1 — as against the “FAAC rate” of N325/$1. That is another N20 per litre. The idea is to keep fuel prices low, but this is clearly a complete distortion of economic realities. NNPC deducts subsidy at source, so we are spending unearned revenue.

In the final analysis, if crude oil prices drop, we are damned. If crude oil prices rise, we are damned. They call it Catch-22. If oil prices go down, our revenue will drop, forex inflow will drop, and the naira will come under intense pressure. It could be devalued in response to the forex crunch and other fundamentals. When oil prices went below $30 in 2016, our economy was sent into a tailspin. We dipped into recession — although many would argue that Buhari’s policies made a bad case worse. The crunch certainly worsened poverty, heightened inequality and, inevitably, fuelled crime in the land. It was only when oil prices started going back up that we got some relief.

Nevertheless, when oil prices go up, things only get better, not that they become good. Our revenue will surely go up, forex inflow will improve, the naira will breathe more easily — but much of what we are gaining in revenue will be sprayed on subsidies. In the past when oil prices went up — even as high as $147 — we did not see proportionate levels of development. It was a case of economic growth fuelled by high oil prices, not economic development, which is what really impacts on the quality of life of the people. We merely raised wasteful expenditure, embarked on fancy projects, ballooned the civil service, increased public wage bills and put the treasury on the looting mode.

Today, Nigeria’s public finance is so debilitating and dire that anyone who understands simple arithmetic could develop a heart attack. Just take a look at the 2020 federal budget proposals. We propose to spend N9.79 trillion and generate N7.64 trillion. Look at it closely. We are going to be in deficit by N2.142 trillion. We have been perpetually in deficit for decades, in any case, but it keeps growing. Of the N9.79 trillion proposed expenditure for 2020, we will service our debts with N2.45trillion. That is about 32% of our income! We have not stopped borrowing by the way, so our children and grandchildren have their futures well cut out for them!

It gets scarier. The personnel cost for federal ministries, departments and agencies (MDAs) is N2.675 trillion. For government-owned enterprises, there is an additional N218.8 billion. Put together, that is about 38% of the budgeted revenue. Overheads will be N280.3 billion for MDAs and N146.14 billion for the enterprises. Capital expenditure — the kind of projects that we can see with our naked eyes — will be N2.05 trillion. Did you notice something? We will spend N2.675 trillion on MDAs’ personnel cost and N2.45trillion on debt servicing but a mere N2.05 trillion on capital projects! It is not as if we have any choice — we must pay salaries and service our debts. Something must suffer.

Federal government expects to earn N2.454 trillion from oil next year. Hang on. The entire projected oil revenue cannot even pay the personnel cost of the MDAs! The personnel cost is N2.675 trillion. The oil revenue has not been sufficient to pay personnel cost since 2017. Meanwhile, personnel cost will be executed 100% because workers must collect their salaries and allowances, while, from experience, there will be no enough funds for capital projects. The average funding for capital projects has been 60% in recent years — and this was only possible through more loans. Overheads, which civil servants need to function well, also suffer along with capital projects.

You must have noticed that all we have been discussing is the federal budget. By the time we go to the states, we will be depressed. Unfortunately, every discourse in Nigeria starts and ends with the federal government. In a recent report, Bloomberg noted that Nigeria “spends four times more money subsidizing fuel than building new schools, health centers and equipping new science labs”. All the figures used were from the federal budget. The health and education budgets of the 36 states were completely omitted. Is this an indication that we do not reckon with the states — even though they have a key role to play in the development of Nigeria?

Actually, the states are in a worse position financially. They are complaining that they cannot pay the new minimum national wage. They are under pressure to repay the bailout they collected from the federal government in 2016. We do not analyse the budget performance in states, looking at indications such as how much was released for capital projects compared to personnel cost and how well the states are doing in terms of financing education, roads and healthcare. I suspect it would be a gory story. Truly, we are in a fiscal mess as a nation. We do not generate enough income and even what we generate is spent mostly on items that aid consumption rather than facilitate production.

How do we get out of this quagmire? You are asking the wrong person. I do not know. On paper, all that Buhari has to do, according to experts, is get rid of the subsidies and wastes, increase the taxes and adjust the exchange rate. These measures, they argue, will free up funds and provide the ground realities the economy needs to bounce back properly. Many experts have also argued that the personnel cost should be managed within reasonable limits — meaning the government at all levels must prune the civil service, get read of deadwoods and merge some MDAs. Estimates put the population of civil servants and political officer holders at five million nationwide. Humongous!

These measures look very easy and doable on paper. However, a “simple” N1 increase in the price of petrol will send everything haywire — from transport fares to the price of garri — and possibly cause civil unrest. An increase in the prices of bread and petrol led to the fall of President Omar al-Bashir of Sudan. The price increases were necessary but the political backlash was fatal. In 2012, President Goodluck Jonathan removed fuel subsidy in a purely technical/economic decision, but the political cost damaged his presidency. He never recovered from the backlash and there is a sense in which we can argue that it laid the foundation for his demise.

This argument can be countered. Unlike Jonathan, Buhari is not seeking any re-election, so the political costs might not be lethal. He came to office promising to fix the economy — as well as tackle corruption and insecurity. But he cannot fix the economy by running away from taking the hard decisions that will definitely hurt Nigerians in the short run but build a sure foundation for the future. We are paying huge bills that we cannot afford, just to keep electricity tariffs and petrol price low in order “to protect the poor”. So we would rather pour $5 billion into fuel subsidy than fund education, infrastructure and healthcare — which are more beneficial to the poor in the real sense.

I do not envy Buhari. He has picked an Economic Advisory Council made of eminent economists that will surely recommend bitter pills to him. But Buhari, from what I can see, thinks he has the mandate of the masses and whatever policies he adopts must protect the poor. He will have to deal with one thing: that what is economically right may be politically explosive. I do not expect him to get rid of subsidies in one fell swoop — that is if he will consider that option at all. At the same time, something has to give. We have a chronic revenue crisis. The economy will be brought to its knees if things continue the way they are now — expect, of course, oil prices hit $100 and above.

AND FOUR OTHER THINGS…

THE NO. 16

As Vice-President Yemi Osinbajo faces a political crisis, purportedly ahead of 2023, a newspaper reports that President Muhammadu Buhari is already shopping for his replacement. It says a popular south-west cleric, apparently Pastor Tunde Bakare (who was Buhari’s running mate in 2011), has been tipped to replace Osinbajo as VP. Then a video suddenly surfaces with Bakare describing himself as No. 16 “in the scheme of Nigerian politics” — next to Buhari who is “No. 15”. Social media catches fire in an instant. The only problem, though, is that the video was recorded in February 2018 and has nothing to do with Osinbajo. But this is how fake news works. Mischief.

P&ID UPDATE

If you are too busy to follow the case between Nigeria and P&ID over the arbitral award, here is your briefing. Nigeria asked for two things: leave to appeal the enforcement order granted by the London court and a stay of execution on the award itself, currently valued at $9.6 billion (interests are still accumulating). Justice Butcher granted the leave to appeal the enforcement (you do not appeal in an arbitration; you only try to set it aside). The judge also granted stay of execution (the original award has not been set aside) on the ground that we should deposit $200 million within 60 days and we must also pay $250,000 (not $250 million) as legal costs to P&ID. Stay tuned. Unfolding.

ON SOWORE

Omoyele Sowore, politician, publisher and activist, is supposed to be breathing the air of freedom now after he was granted bail by a federal high court in Abuja. However, the Department of State Services (DSS) has refused to release the man it arrested on August 2 ahead of a planned nationwide #RevolutionNow protest. DSS has filed charges — significantly accusing Sowore of treason, which carries the death penalty. Now, ladies and gentlemen, I think we are beginning to take this thing too seriously. I certainly oppose Sowore saying the DSS would cease to exist after the #RevolutionNow protests, but the DSS has to start learning how to obey court orders. Simple.

SAVING SIASIA

Spare a thought for Samson Siasia, the former Super Eagles player and coach. His mother, Ogere Betty, was kidnapped at her Odoni residence in Sagbama, Bayelsa state, in July. The 76-year-old woman is yet to regain her freedom because Siasia cannot meet the ransom requirement. He was able to gather some funds to send to the kidnappers, but after collecting the money, which they considered inadequate, they have been detaining his messenger. While we were at it, he was banned from football for life by FIFA over match-fixing allegations. He needs to raise money for pay legal costs towards upturning the ban. “I feel abandoned,” Siasia told TheCable last week. Pity.

Comments

Post a Comment